According to the notice of INE, INE adjusted the Price limit of Crude Oil futures from 6% to 8%, the Price limit of No.20 Rubber from 7% to 9%, and be effective on 23rd Jan,2019.

http://www.ine.cn/en/news/notice/2513.html

By the end of market close on February 3,the active SC(Shanghai Crude) and TR contracts closed at limit down (8% and 9%) due to the collapse in oversea market and the impact of coronavirus.

www.ine.cn/en/bourseService/summary/?name=tradingdaily

http://www.ine.cn/en/bourseService/businessdata/calendar/

Contracts SC2003-SC2005、SC2007、Contract NR2002、Contracts NR2003-NR2005 have reached the first price-down limit, according to the exchange rules-- Risk Management Rules of the Shanghai International Energy

Exchange, Article 16 and Article 17, adjust the Price limit and margin on the next trading day(D2 Day),

And predict the Price limit and margin on D3 Day:

D1 Day(3rd Feb,2020)

D2

Day(4th Feb,2020)

Price

limit

Margin

Price

limit

Margin

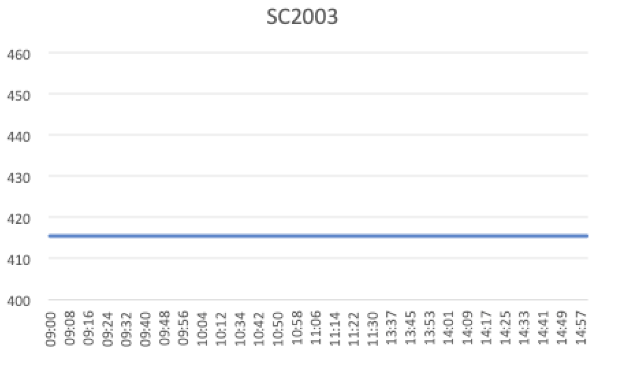

SC2003

8%

10%

11%(=8%+3%)

13%(=11%+2%)

SC2004-2005, SC2007

8%

9%

11%(=8%+3%)

13%(=11%+2%)

D1 Day(3rd Feb,2020)

D2

Day(4th Feb,2020)

Price

limit

Margin

Price

limit

Margin

NR2002

9%

15%(Delivery

month)

12%(=9%+3%)

15%(Delivery

month)

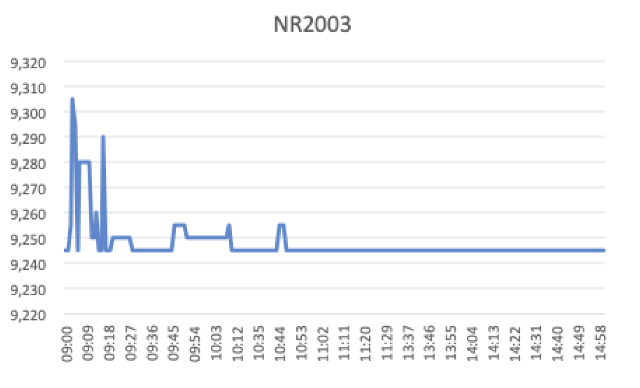

NR2003-NR2005

9%

11%

12%(=9%+3%)

14%(=12%+2%)

|

|

If reach the second price-down limit on D2 |

If not reach the second price-down limit on D2 |

||

|

D3 Day (5th Feb,2020) |

D3 Day (5th Feb,2020) |

|||

|

Price limit |

Margin |

Price limit |

Margin |

|

|

SC2003 |

13%(=8%+5%) |

15%(=13%+2%) |

6% |

10%( one month before delivery) |

|

SC2004-2005, SC2007 |

13%(=8%+5%) |

15%(=13%+2%) |

6% |

7% |

|

|

D3 Day (5th Feb,2020) |

D3 Day (5th Feb,2020) |

||

|

Price limit |

Margin |

Price limit |

Margin |

|

|

NR2002 |

14%(=9%+5%) |

16%(=14%+2%) |

7% |

15%(Delivery month) |

|

NR2003-NR2005 |

14%(=9%+5%) |

16%(=14%+2%) |

7% |

NR2003:10%(one month before delivery) NR2004-NR2005: 9% |

http://www.ine.cn/en/regulation/regulation/1892.html

Article 16 In the event that a Limit-locked market occurs to a futures contract on a trading day (denoted as D1, whereas D0 represents the previous trading day, and the following five (5) successive trading days are D2, D3, D4, D5 and D6), the price limit and the trading margin for the futures contract on D2 shall be adjusted as follows:

1. the same direction limit price for D2 shall be fixed at three percent (3%) greater than that for D1; (Price limit of SC2003 on D1 is 8%, so the Price limit of SC2003 on D2 is 8%+3%=11%)

2. the trading margin on D2 shall be fixed at two percent (2%) greater than the percentage range or price limit for D2. (the Price limit of SC2003 on D2 is 11%, so the margin of SC2003 on D2 is 11%+2%=13%)

If the adjusted trading margin is smaller than what is applied at the clearing of D0, the same trading margin applied on D0 shall be used as the trading margin for that contract.

Article 17 The price limit and trading margin for the futures contract described in Article 16 of these Risk Management Rules on D3 shall be adjusted as follows:

1. If a same direction Limit-locked market does not occur on D2, the price limit and trading margin for D3 shall return to the normal level;

2. If a reverse direction Limit-locked market occurs on D2, a new round of a Limit-locked market is deemed to be triggered, i.e. D2 shall become D1 for the new round of Limit-locked market, and the trading margin rate and

the price limit for the following trading day shall be set pursuant to Article 16 of these Risk Management Rules; or

3. If the same direction Limit-locked market exists on D2, the price limit for D3 shall be fixed at 5 percent (%) above the price limit on D1, and the trading margin shall be fixed at 2 percent (%)above the regular price limit for D3. If the adjusted trading margin is smaller than what was applied at the clearing of D0, the trading margin on D0 will be applied to meet the margin requirements for that contract.